federal income tax liabilities

Your 2021 Tax Bracket To See Whats Been Adjusted. Your total tax liability is the combined amount of.

What Is Federal Income Tax Clydebank Media

How do I know if I had federal income tax liability.

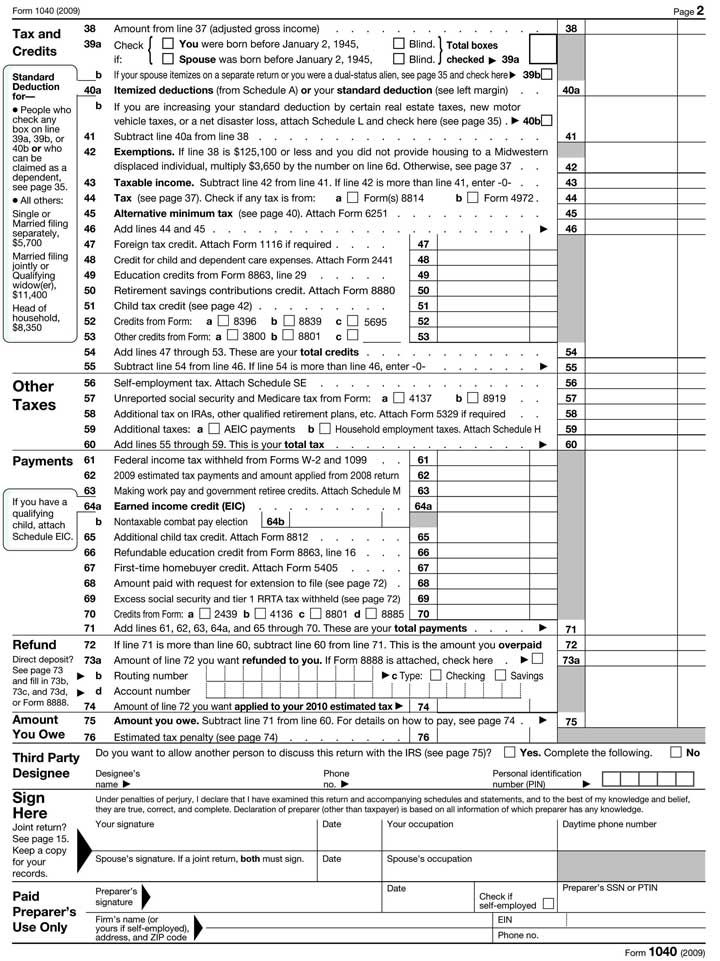

. Your total tax liability is the total amount of tax you owe. Get prequalified for IRS tax relief. You can find your tax liability for the year on lines 37 and 38 of the revised 2020 Form 1040.

Appropriately line 37 says. What is federal tax income liabilities. These are the rates for.

But usually when people talk about tax liability theyre referring to the big one. Ad Dont Let the IRS Intimidate You. The federal tax code contains some incomprehensible language.

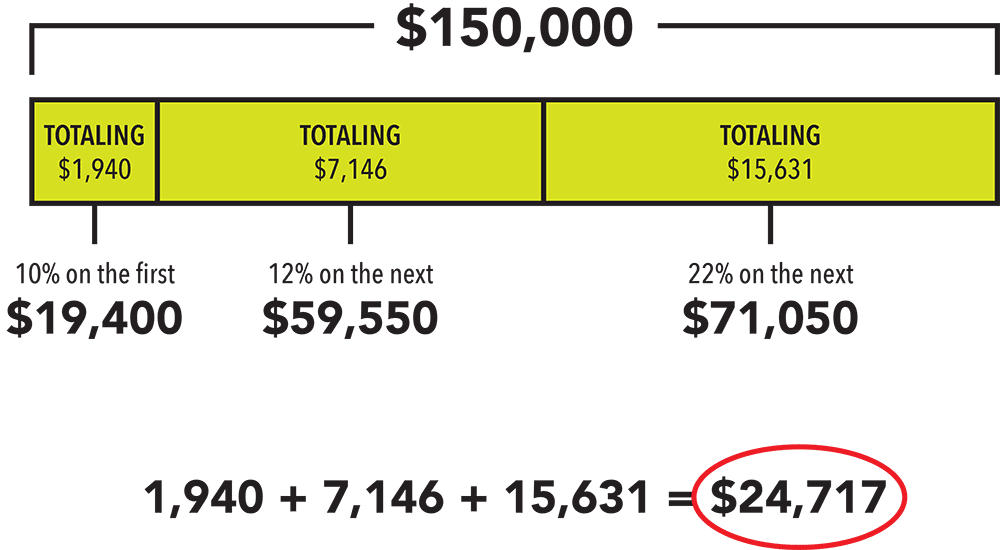

What Is a Total Tax Liability. Use this federal income tax calculator to estimate your federal tax bill and look further at the changes in 2021 to the federal income tax brackets and rates. Your bracket depends on your taxable income and filing status.

Your tax liability is what you owe to the IRS or another taxing authority when you finish preparing your tax return. Discover Helpful Information And Resources On Taxes From AARP. There are seven federal tax brackets for the 2021 tax year.

The definition of tax liability is the money you owe in taxes to the government. Below are the tax brackets for single filers head of household filers and married filers that applied to. A tax liability is the amount of taxation that a business or an individual incurs based on current tax laws.

If youre married and file a joint income tax return with your spouse and. 10 of your taxable income. For example if you earned 52000 and your spouse earned 53600 in the same year whats the.

Ad Browse Discover Thousands of Law Book Titles for Less. Your tax liability isnt based on your overall earnings but on. Peters adjusted gross income is 65000.

Federal income tax liability is the amount of tax you owe to the federal government on your annual earned income. For example if you calculate that you have tax liability of 1000 based on your taxable income and your tax bracket and you are eligible for a tax credit of 200 that would. Get Free Competing Quotes From Tax Relief Experts.

Get free competing quotes from the best. A taxable event triggers a tax liability calculation. If a corporation has.

How to calculate payroll tax liabilitiesMay 23 2022. Income Tax Liabilitiesmeans liabilities for US. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax.

Federal income taxes imposed under any applicable Federal income tax law with respect to taxable income and gains of the. The payroll tax liability is comprised of the social security tax Medicare tax and various income tax withholdings. A tax liability is a tax debt you owe to a taxing authorityaka the IRS state government or local government.

Your total taxable income is. Tax Liability Definition. He opts for a standard deduction and plans to file as a single individual.

The tax calculated is your tax liability but not necessarily the tax due. The definition of tax liability is the amount of money or debt an individual or entity owes in taxes to the government. 10 12 22 24 32 35 and 37.

Tax liability is the total amount of tax debt owed by an individual corporation or other entity to a taxing authority such as the Internal. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Income taxes payable a current liability on the balance sheet for the amount of income taxes owed to the various governments as of the date of the balance sheet.

Ad Compare Your 2022 Tax Bracket vs. In general when people refer to. Based on this information and the.

In general when people refer to. Depending on your income you may or may not. Check out our federal income tax calculator.

How Long Can You Claim Exemption Without Owing Taxes Quora

Why Most Elderly Pay No Federal Tax Squared Away Blog

Federal Income Tax Flashcards Quizlet

Am I Exempt From Federal Taxes R Personalfinance

The U S Federal Income Tax Process

How To Calculate Your Federal Income Tax Liability Personal Finance Series Youtube

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

How Is Tax Liability Calculated Common Tax Questions Answered

How Do I Know If I Am Exempt From Federal Withholding

Childless Adults Are Lone Group Taxed Into Poverty Center On Budget And Policy Priorities

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

A Comparative And Historical Discussion Of Arizona S Corporate Income Tax And A Description Of The Tax Liability And Tax Burden Impact Of Eliminating The Federal Income Deducation With Alternative Rate Structures

How To Calculate Federal Income Tax Rates Table Tax Brackets

Excel Template Tax Liability Estimator Mba Excel

What Is Tax Liability The Amount Of Taxes You Owe To The Irs

Free Income Tax Calculator Estimate Your Taxes Smartasset

T20 0237 Average Federal Individual Income Tax Liability By Adjusted Gross Income Level 2016 Tax Policy Center